The Township of Greater Madawaska is responsible for the billing and collection of property taxes for the Township and on behalf of the County of Renfrew and the local school boards. Tax billing is based on your property assessment and the tax rate approved by Council.

Tax Billing |

| We issue two tax bills each year – an interim bill and a final bill. The due dates will vary by year and will be indicated on your tax bill.

Your interim billing payment is generally due near the end of March, exact date is on your tax bill. Your final billing payment is generally due near the end of September, exact date is on your tax bill. |

Property Tax Billing Reprints |

| If you have lost your property tax bill and require a replacement, please complete the Property Tax Reprint Request form and submit with the fee of $10 for your request. Reprints will only be provided to the property owner(s). Requests and fees can be made in person at the office (payments accepted by cash, cheque or debit), requests can also be made by email to the Finance department and paid by e-transfer. Details regarding e-transfer will be sent once the request is received. |

Late Penalties |

| The Township of Greater Madawaska must receive all tax payments by the installment due date on your tax bill. If you miss the due date, you will receive a penalty of 1.25% per month. Late penalties will be applied the first of every month. |

E-Billing |

| Some exciting news! We are currently in the process of upgrading our financial software, which means that e-billing is temporarily unavailable. Once the transition is complete, you will be able to log into your tax account(s) through an e-billing portal any time to check the status!! Instructions on how to sign up for this feature will be available soon! |

Address and Ownership changes |

|

It is important to notify the finance department in writing of any changes to your mailing address to ensure our records are up to date. Submit an address change now. The Township is unable to make changes to ownership to properties without notice from a lawyer with the transfer documents or notification from the Municipal Property Assessment Corporation (MPAC). |

Tax Certificates |

|

To request a tax certificate, complete the online Tax Certificate Request Form. The fee of $60.00 must be sent to the Township by mail to PO Box 180, Calabogie, ON K0J 1H0. |

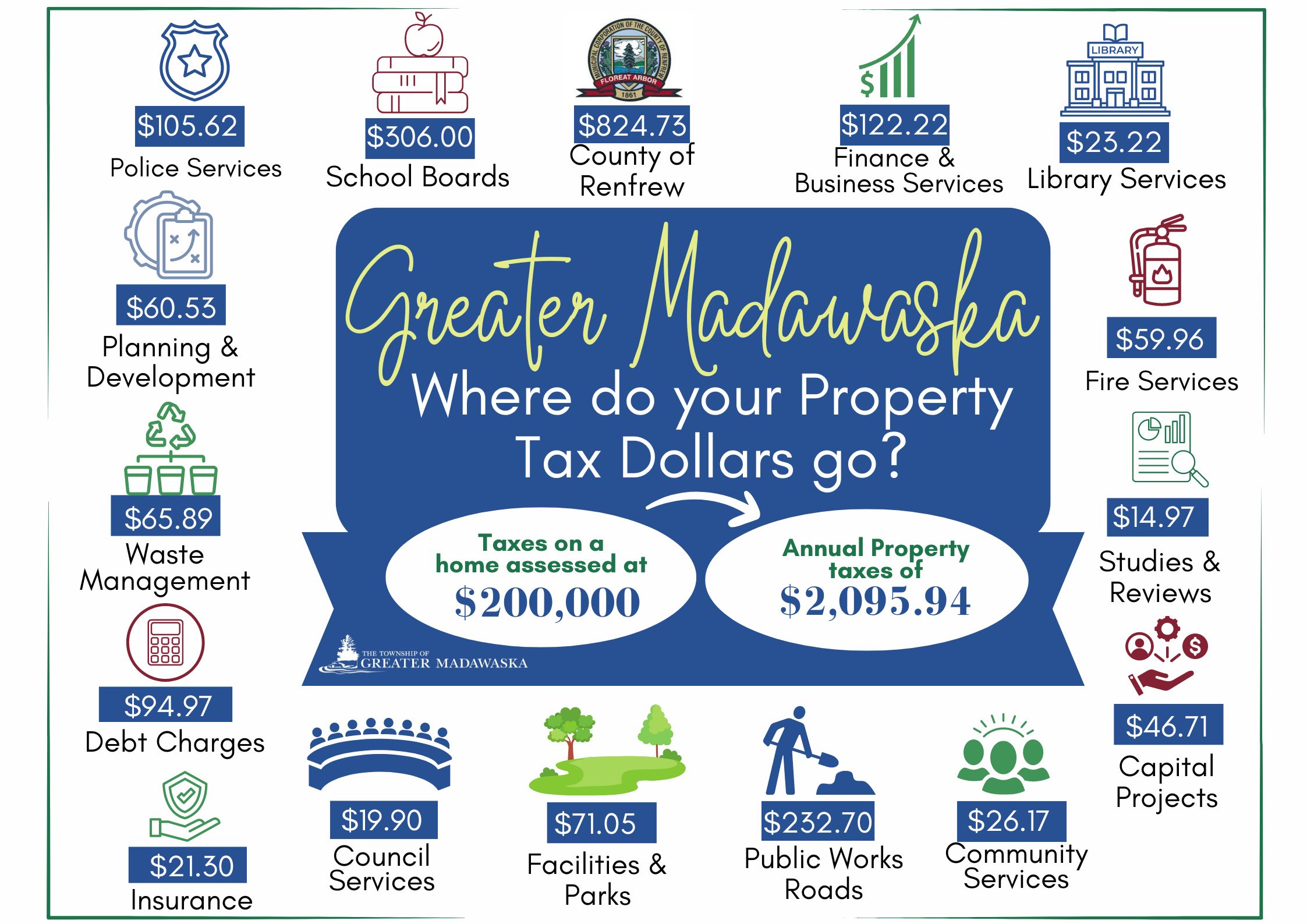

How your Property Taxes are Calculated |

|

Property taxes are calculated by multiplying the assessed value of a property by the tax rate applicable to the class of the property. The tax rates are calculated as follows: Step 1: Taxable Assessment X Tax Ratios = Weighted Assessment Step 2: Levy Requirement / Weighted Assessment = Residential Tax Rate Taxable assessment is established by the Municipal Property Assessment Corporation (MPAC). The Ontario government has announced that the 2020 Assessment Update has been postponed. They have indicated that curernt property assessments will continue to be based on the fully phased-in January 1, 2016 current values. The levy requirement is the amount of taxes required to be raised after deducting all non-tax revenue from the total cost of providing municipal services. The Municipal Property Assessment Corporation (MPAC) website offers an abundance of information regarding property assessment. A brief video describing the process of how your property tax is calculated is available on the Municipal Property Assessment Corporation Youtube channel. |

Tax Rates |

|

The Township of Greater Madawaska sets annual property tax rate based on the Township budget, this is approved by Council. |

Tax Sale Listings |

|

Take Notice that tenders are invited for the purchase of the lands described below and will be received until 3:00 p.m. local time on April 24, 2025, at the Greater Madawaska Municipal Office, 19 Parnell St. Calabogie Ontario. The tenders will then be opened in public on the same day as soon as possible after 3:00 p.m. at the Greater Madawaska Municipal Office, 19 Parnell St. Calabogie. Description of Lands: 1. Roll No. 47 06 012 050 10650 0000; GRIFFITH; PIN 57487-0148 (LT); PT LT 10, CON 4, MATAWATCHAN, AS IN MT688; GRIFFITH & MATAWATCHAN; File No. 22-03 According to the last returned assessment roll, the assessed value of the land is $23,000 Minimum tender amount: $21,114.47 2. Roll No. 47 06 009 035 07600 0000; 6062 HIGHWAY 132, DACRE; PIN 57384-0031 (LT); PT LTS 23 & 24, RANGE "D" NORTH, BROUGHAM AS IN R406773; TOWNSHIP OF GREATER MADAWASKA; File No. 22-05 According to the last returned assessment roll, the assessed value of the land is $180,000 Minimum tender amount: $37,294.65 3. Roll No. 47 06 006 010 40700 0000; 12783 LANARK RD., CALABOGIE; PIN 57351-0225 (LT); PT E 1/2 LT 18, CON 10 AS IN R330548, BAGOT; BAGOT BLYTHFLD BROUGHAM; File No. 22-07 According to the last returned assessment roll, the assessed value of the land is $21,500 Minimum tender amount: $65,416.55

In the event the Frequently Asked Questions does not answer all of your questions, you can contact Jessica at 613-752-2274 or by e-mail.

Please note the Township cannot provide legal advice. For information on the available properties and to download a tender package please visit the Ontario Tax Sales website.

|

Contact Us

Subscribe to this page

Subscribe to this page