The Township of Greater Madawaska is responsible for the billing and collection of property taxes for the Township and on behalf of the County of Renfrew and the local school boards. Tax billing is based on your property assessment and the tax rate approved by Council.

Online Financial Services Portal - E-billing now launched!

Tax Billing |

|

We issue two tax bills each year – an interim bill and a final bill. The due date of the interim bill is typically near the end of March. The exact due date is on your tax bill. The due date of the final bill is typically near the end of September. The exact due date is on your tax bill. |

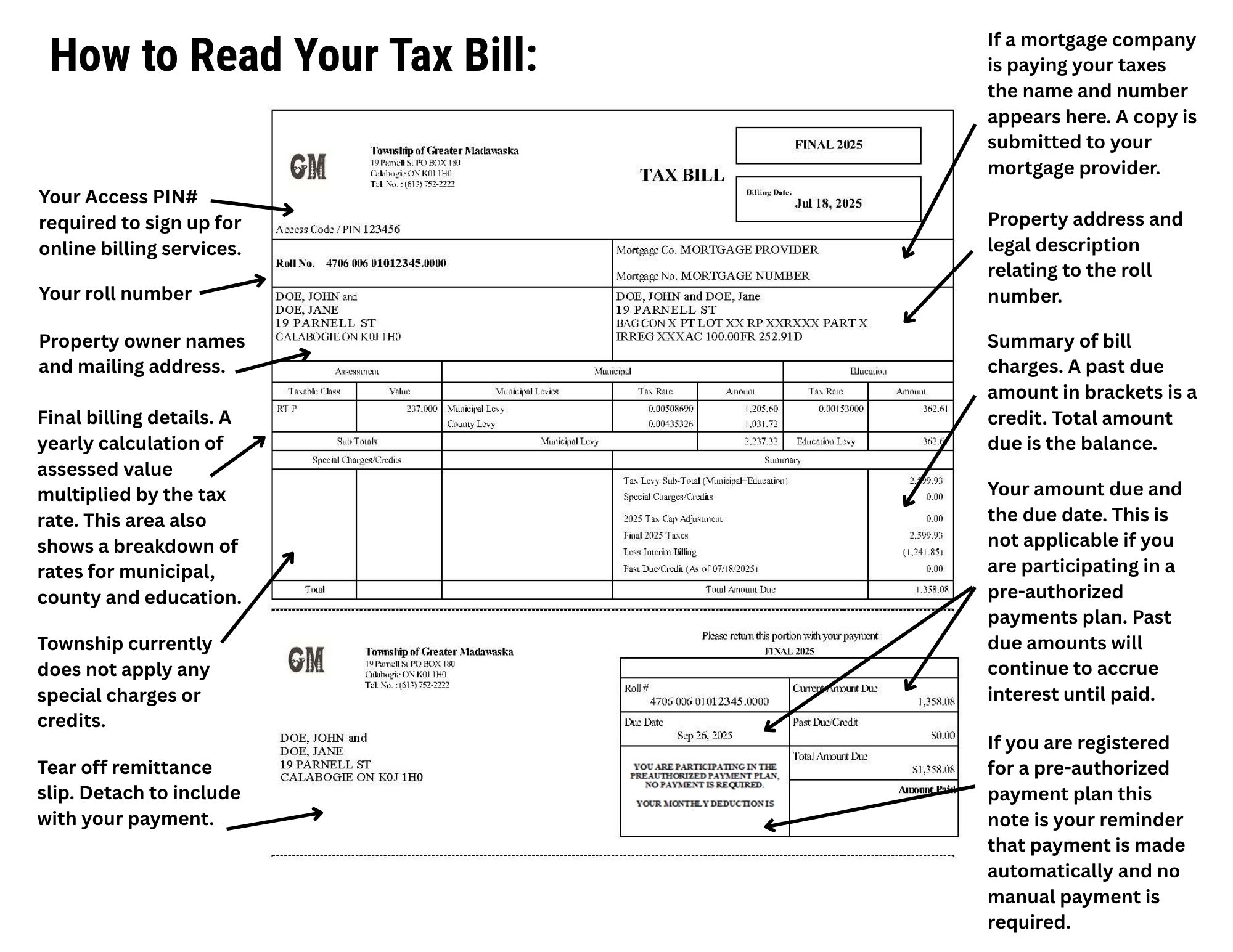

How to Read Your Tax Bill |

|

Your Tax Bill includes the following information:

|

Property Tax Billing Reprints |

| If you have lost your property tax bill and require a replacement, please complete the Property Tax Reprint Request form and submit with the fee of $10 for your request. Reprints will only be provided to the property owner(s). Requests and payments can also be made in person at the office (payments accepted by cash, cheque or debit). Requests can also be made by email to the Finance department and paid by e-transfer. Details regarding e-transfer will be sent once the request is received. |

Late Penalties |

| The Township of Greater Madawaska must receive all tax payments by the installment due date indicated on your tax bill. If you miss the due date, you will receive a penalty of 1.25% per month. Late penalties will be applied the first of every month. |

E-Billing |

|

Online Financial Services Portal - E-billing now launched!

LET'S GET STARTED. Residents may start using the Online Services by following these 3 simple steps:

1. Obtain your Roll number from a recent tax bill. Contact the Township office for your Access/PIN Number at 613-752-2222 or alternatively by emailing the Tax Department.

2. When you register you will need to enter your roll number excluding the 4706, choose your Jurisdiction 006, 009 or 012 and the next 8 digits of your roll number plus .0000.

3. Register your account by selecting the button below:

IMPORTANT: If you choose "Attach a pdf bill with my Property Tax Notice" when setting up your tax account, you will not receive a printed bill from the Township.

Please select the correct option as we have a $10.00 Administration Fee for a Tax Bill Reprint to be mailed or emailed to our residents.

KEEP YOUR PIN# PRIVATE

|

Address and Ownership changes |

|

It is important to notify the finance department in writing of any changes to your mailing address to ensure our records are up to date. To submit an address change complete the online address change form or send an email to the Finance Department. Property Ownership changes will only be processed through the receipt of notice from a lawyer or notification from Municipal Property Assessment Corporation (MPAC). |

Official Tax Certificates |

|

To request an official tax certificate, complete the online Tax Certificate Request Form. The fee of $60.00 must be sent to the Township by mail to PO Box 180, Calabogie, ON K0J 1H0. |

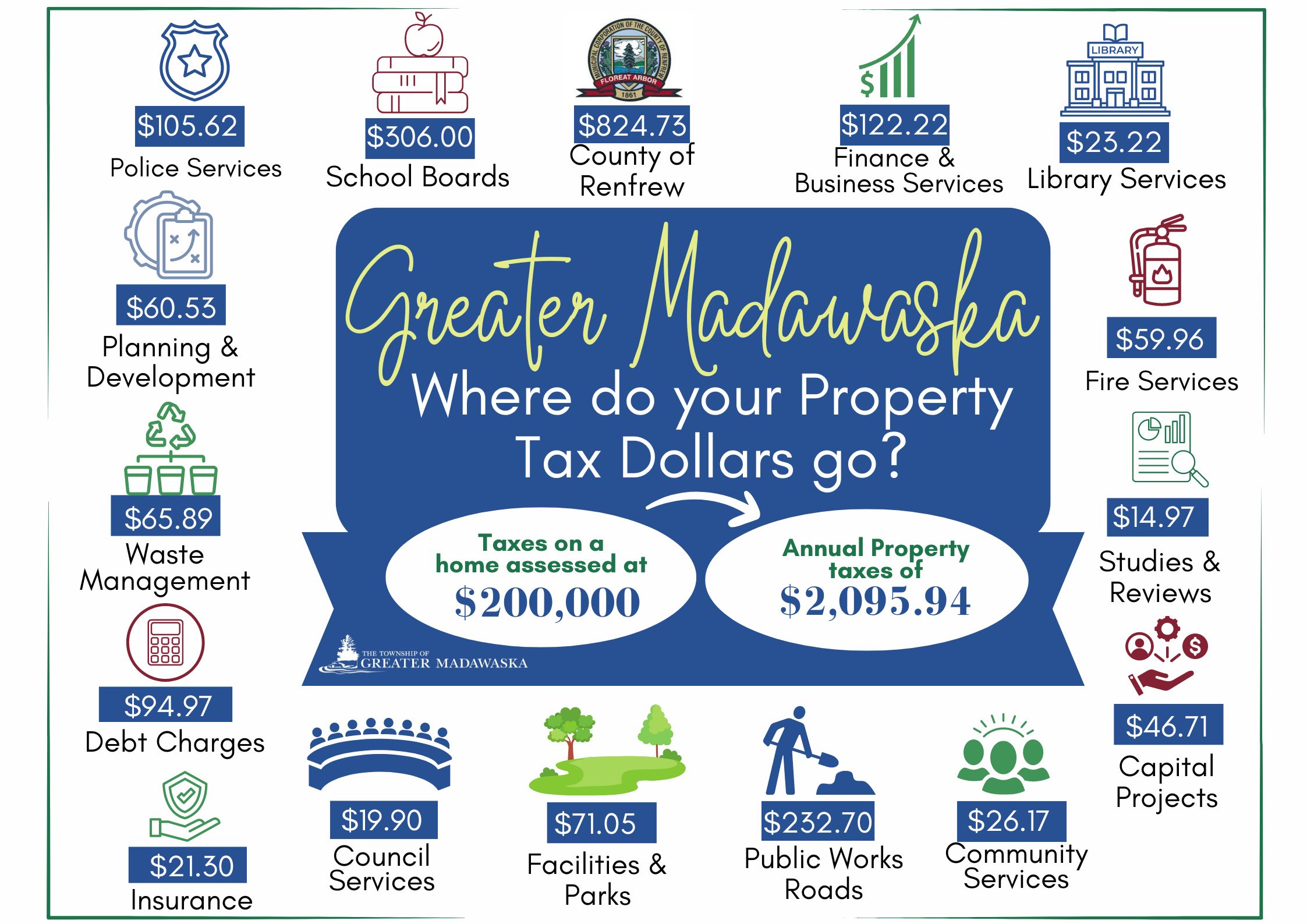

How your Property Taxes are Calculated |

|

Property taxes are calculated by multiplying the assessed value of a property by the tax rate applicable to the class of the property. The tax rates are calculated as follows: Step 1: Taxable Assessment X Tax Ratios = Weighted Assessment Step 2: Levy Requirement / Weighted Assessment = Residential Tax Rate Taxable assessment is established by the Municipal Property Assessment Corporation (MPAC). The Ontario government has announced that the 2020 Assessment Update has been postponed. They have indicated that current property assessments will continue to be based on the fully phased-in January 1, 2016 current values. The levy requirement is the amount of taxes required to be raised after deducting all non-tax revenue from the total cost of providing municipal services. The Municipal Property Assessment Corporation (MPAC) website offers an abundance of information regarding property assessment. A brief video describing the process of how your property tax is calculated is available on the Municipal Property Assessment Corporation Youtube channel. |

Tax Rates |

|

The Township of Greater Madawaska sets the annual property tax rates based on the Township budget. The rates are approved by Council. |

Tax Sale Listings |

|

There are currently no Tax Sale Properties listed. In the event the Frequently Asked Questions does not answer all of your questions, you can contact Jessica at 613-752-2274 or by e-mail. Please note that the Township cannot provide legal advice. For information on Tax Sales please visit the Ontario Tax Sales website. |

Contact Us

Subscribe to this page

Subscribe to this page