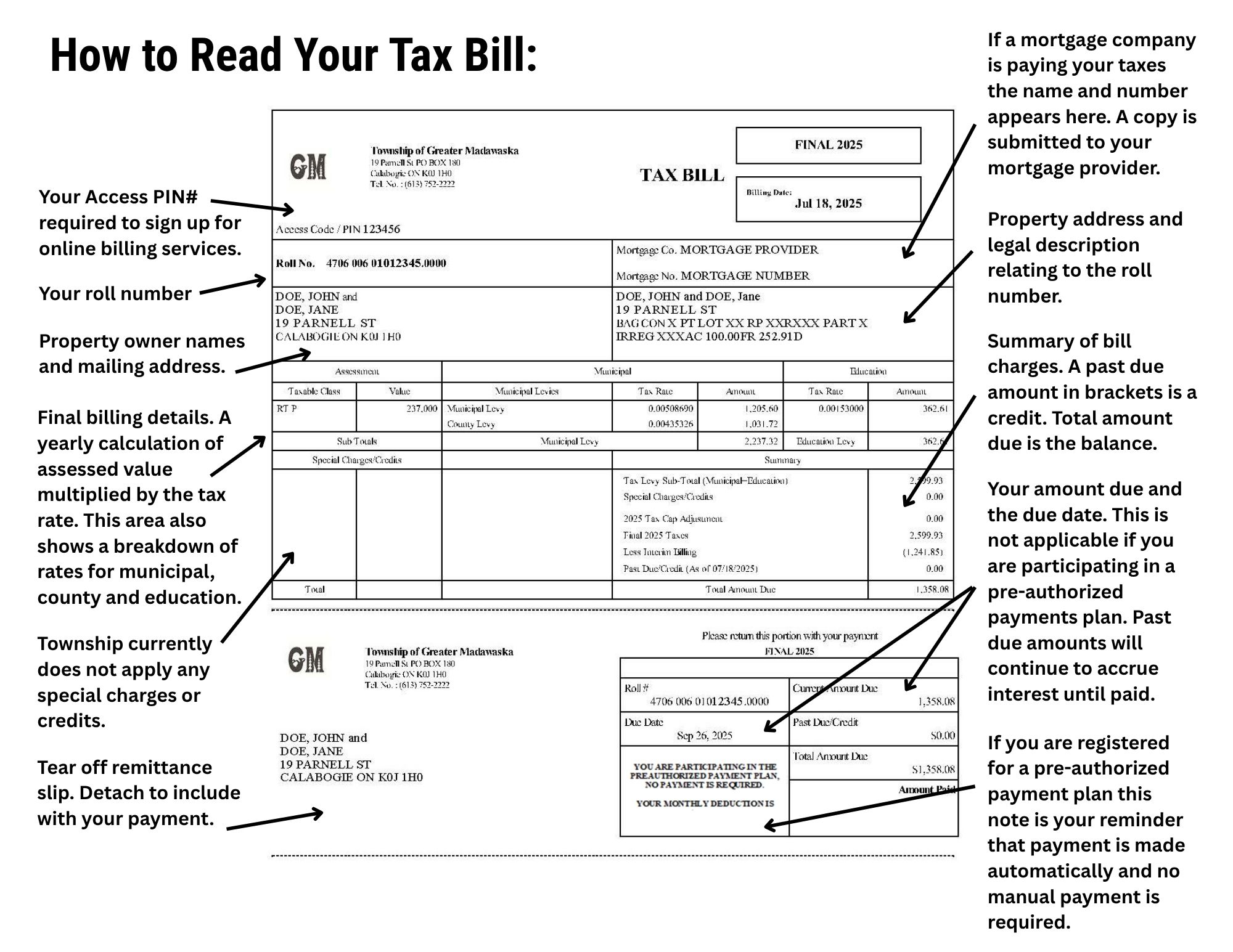

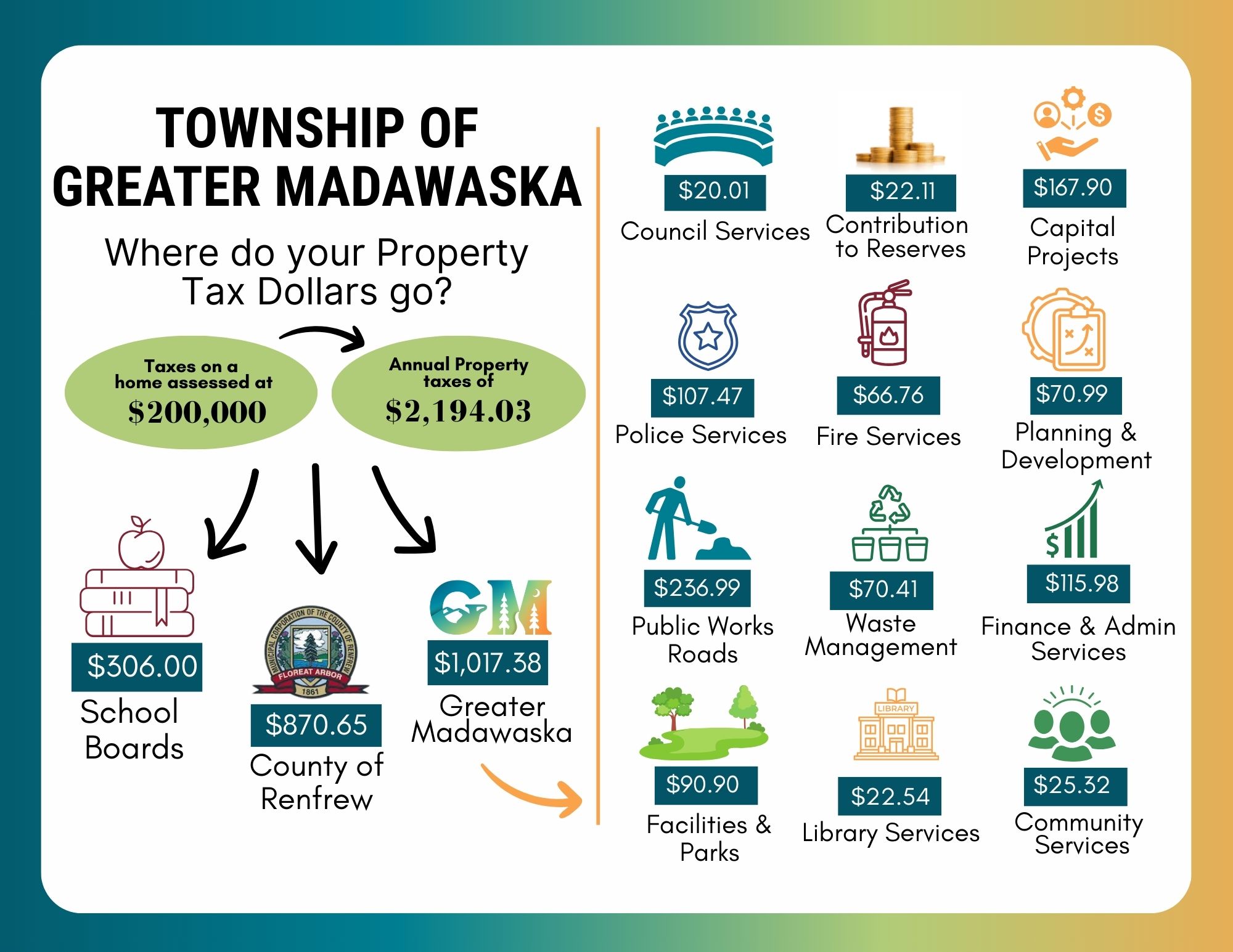

Property taxes are calculated by multiplying the assessed value of a property by the tax rate applicable to the class of the property.

The tax rates are calculated as follows:

Step 1: Taxable Assessment X Tax Ratios = Weighted Assessment

Step 2: Levy Requirement / Weighted Assessment = Residential Tax Rate

Taxable assessment is established by the Municipal Property Assessment Corporation (MPAC). The Ontario government has announced that the 2020 Assessment Update has been postponed. They have indicated that current property assessments will continue to be based on the fully phased-in January 1, 2016 current values.

The levy requirement is the amount of taxes required to be raised after deducting all non-tax revenue from the total cost of providing municipal services.

The Municipal Property Assessment Corporation (MPAC) website offers an abundance of information regarding property assessment. A brief video describing the process of how your property tax is calculated is available on the Municipal Property Assessment Corporation Youtube channel.